Uncover Dave Ramsey's Secrets For Young Financial Success

Dave Ramsey's teachings on personal finance, geared towards young people.

Dave Ramsey is a financial author, radio host, and businessman who has helped millions of people get out of debt and build wealth. His teachings are based on the principles of living on a budget, saving money, and investing for the future. Ramsey's advice is particularly relevant for young people, who are just starting out in their financial lives.

Ramsey's "Baby Steps" plan is a simple and effective way for young people to get their finances in order. The first step is to save $1,000 for emergencies. Once you have an emergency fund, you can start paying off your debt. Ramsey recommends using the "debt snowball" method, which involves paying off your smallest debts first. Once you have paid off all of your debt, you can start saving for the future.

Ramsey's teachings can help young people avoid the common financial pitfalls that many people fall into. By following his advice, young people can set themselves up for a lifetime of financial success.

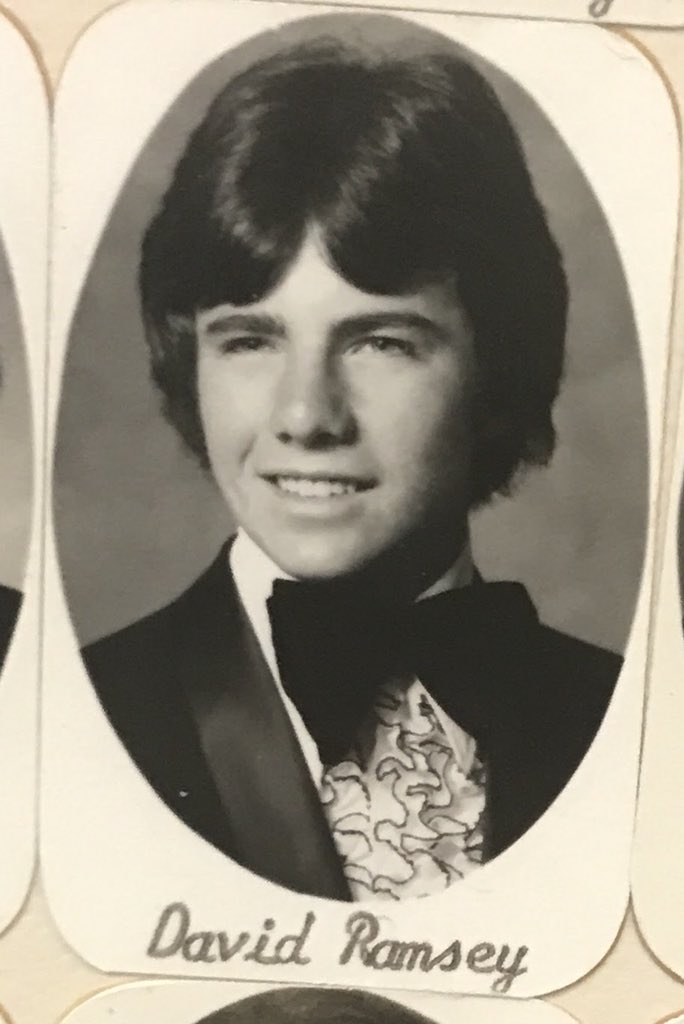

Dave Ramsey Young

Dave Ramsey's teachings on personal finance are particularly relevant for young people, who are just starting out in their financial lives. Ramsey's "Baby Steps" plan is a simple and effective way for young people to get their finances in order and avoid the common financial pitfalls that many people fall into.

- Budgeting

- Saving

- Debt repayment

- Investing

- Emergency fund

- Financial goals

- Credit

- Insurance

- Taxes

- Retirement

By following Ramsey's advice, young people can set themselves up for a lifetime of financial success. For example, by budgeting and saving money, young people can avoid the need to rely on credit cards and other forms of debt. By investing early, young people can take advantage of the power of compound interest and grow their wealth over time. And by planning for retirement early, young people can ensure that they have a comfortable financial future.

| Name | Dave Ramsey |

| Occupation | Financial author, radio host, and businessman |

| Date of birth | September 3, 1960 |

| Place of birth | Nashville, Tennessee |

| Spouse | Sharon Ramsey |

| Children | Three |

Budgeting

Budgeting is one of the most important aspects of Dave Ramsey's financial plan for young people. A budget is a plan for how you will spend your money each month. It helps you to track your income and expenses so that you can make sure that you are living within your means. By following his advice, young people can set themselves up for a lifetime of financial success.

- Creating a Budget

The first step to budgeting is to create a budget. This can be done using a simple spreadsheet or budgeting app. Once you have created a budget, you need to track your income and expenses for a month. This will help you to see where your money is going and where you can cut back.

- Sticking to Your Budget

Once you have created a budget, the hard part is sticking to it. There will be times when you want to spend money on things that you don't need. However, if you stay disciplined and stick to your budget, you will be surprised at how much money you can save.

- Benefits of Budgeting

There are many benefits to budgeting. Budgeting can help you to:

- Get out of debt

- Save money for emergencies

- Reach your financial goals

- Live a more disciplined life

- Conclusion

Budgeting is an essential part of Dave Ramsey's financial plan for young people. By following his advice, you can set yourself up for a lifetime of financial success.

Saving

Saving is a crucial aspect of Dave Ramsey's financial plan for young people. Ramsey believes that young people should start saving as early as possible, even if it's just a small amount. By saving money, young people can build a financial cushion that can help them weather unexpected expenses, reach their financial goals, and retire comfortably.

- Emergency Fund

One of the first things young people should do is save up an emergency fund. This fund should be used to cover unexpected expenses, such as a car repair or medical bill. Ramsey recommends saving at least $1,000 in an emergency fund.

- Short-Term Savings Goals

Once you have an emergency fund, you can start saving for short-term goals, such as a down payment on a car or a vacation. Ramsey recommends setting specific savings goals and creating a plan to reach them.

- Long-Term Savings Goals

In addition to short-term savings goals, young people should also start saving for long-term goals, such as retirement. Ramsey recommends investing in a Roth IRA or a 401(k) plan. These accounts offer tax-advantaged savings that can help you grow your wealth over time.

- The Power of Compound Interest

One of the most important things to understand about saving is the power of compound interest. Compound interest is the interest that you earn on your interest. Over time, compound interest can help you grow your wealth exponentially.

Saving is an essential part of Dave Ramsey's financial plan for young people. By following his advice, young people can set themselves up for a lifetime of financial success.

Debt repayment

Debt repayment is a crucial component of Dave Ramsey's financial plan for young people. Ramsey believes that young people should avoid debt as much as possible, and if they do have debt, they should pay it off as quickly as possible. Ramsey's "Baby Steps" plan includes a specific plan for paying off debt, which he calls the "debt snowball" method.

The debt snowball method involves paying off your debts one at a time, starting with the smallest debt. Once you have paid off the smallest debt, you move on to the next smallest debt, and so on. This method can help you to stay motivated and make progress on your debt repayment goals.

There are many benefits to paying off debt early. Paying off debt can help you to:

- Save money on interest

- Improve your credit score

- Reduce your stress levels

- Reach your financial goals faster

If you are a young person who is struggling with debt, Dave Ramsey's debt repayment plan can help you to get out of debt and achieve your financial goals. Ramsey's plan is simple, effective, and has helped millions of people to get out of debt and build wealth.

Investing

Investing is a crucial component of Dave Ramsey's financial plan for young people. Ramsey believes that young people should start investing as early as possible, even if it's just a small amount. By investing early, young people can take advantage of the power of compound interest and grow their wealth over time.

- Start Early

One of the most important things to remember about investing is to start early. The sooner you start investing, the more time your money has to grow. Even if you can only invest a small amount each month, it will add up over time.

- Invest Regularly

Another important aspect of investing is to invest regularly. This means setting up a plan to invest a certain amount of money each month, regardless of what the market is doing. By investing regularly, you can dollar-cost average your investments and reduce your risk.

- Invest for the Long Term

Investing is a long-term game. You shouldn't expect to get rich quick. However, if you invest for the long term, you can weather the ups and downs of the market and grow your wealth over time.

- Choose the Right Investments

There are many different types of investments available. It's important to choose investments that are right for your risk tolerance and financial goals. If you're not sure what to invest in, you can talk to a financial advisor.

Investing is an essential part of Dave Ramsey's financial plan for young people. By following his advice, young people can set themselves up for a lifetime of financial success.

Emergency fund

An emergency fund is a crucial component of Dave Ramsey's financial plan for young people. Ramsey believes that young people should save up an emergency fund of at least $1,000 as a buffer against unexpected expenses. This fund can be used to cover costs such as a car repair, a medical bill, or a job loss.

Having an emergency fund can help young people avoid going into debt or using credit cards to cover unexpected expenses. This can save them money on interest and help them stay on track with their financial goals. In addition, having an emergency fund can give young people peace of mind, knowing that they have a financial cushion to fall back on.

Here are some tips for building an emergency fund:

- Set up a separate savings account for your emergency fund.

- Make regular deposits to your emergency fund, even if it's just a small amount.

- Avoid dipping into your emergency fund unless it's absolutely necessary.

Financial goals

Financial goals are an essential component of Dave Ramsey's financial plan for young people. Ramsey believes that young people should start setting financial goals early on, as this will help them to stay focused and motivated on their journey to financial success. Financial goals can be anything from saving for a down payment on a house to retiring early. No matter what your financial goals are, it's important to have a plan in place to achieve them.

One of the most important things to remember when setting financial goals is to make sure that they are realistic and achievable. If your goals are too ambitious, you may become discouraged and give up. It's better to start with small, achievable goals and gradually work your way up to larger goals. For example, if you want to save for a down payment on a house, you could start by setting a goal to save $1,000 in six months. Once you have achieved this goal, you can then set a new goal to save $5,000 in a year. By breaking down your goals into smaller, more manageable steps, you will be more likely to stay on track and achieve them.

Another important aspect of financial goal setting is to make sure that your goals are aligned with your values. What are your priorities in life? What do you want to achieve with your money? Once you know what your values are, you can start to set financial goals that will help you achieve them. For example, if you value education, you could set a goal to save for college. Or, if you value financial security, you could set a goal to retire early.

Setting financial goals is an important part of Dave Ramsey's financial plan for young people. By setting realistic, achievable goals that are aligned with your values, you can set yourself up for a lifetime of financial success.Credit

In Dave Ramsey's financial plan for young people, credit plays a crucial role. Ramsey believes that young people should avoid using credit cards and other forms of debt as much as possible. He argues that credit can be a dangerous tool that can lead to financial ruin. However, Ramsey does recognize that there may be times when young people need to use credit, such as when they are buying a car or a house. In these cases, Ramsey recommends that young people use credit wisely and only borrow what they can afford to repay.

- The dangers of credit

Credit can be a dangerous tool for young people. Many young people are not yet financially mature and may not fully understand the risks of credit. They may be tempted to spend more than they can afford on credit cards or other forms of debt. This can lead to a cycle of debt that can be difficult to break.

- When credit is necessary

There may be times when young people need to use credit. For example, young people who are buying a car or a house may need to take out a loan. In these cases, it is important to use credit wisely and only borrow what you can afford to repay.

- Using credit wisely

If you do decide to use credit, there are a few things you should keep in mind. First, only borrow what you can afford to repay. Second, make sure you understand the terms of your loan, including the interest rate and the repayment schedule. Third, make your payments on time and in full each month.

- Building a good credit history

Using credit wisely can help you build a good credit history. A good credit history will make it easier to qualify for loans in the future and can also help you get lower interest rates.

Credit can be a helpful tool, but it is important to use it wisely. If you are a young person, it is important to be aware of the dangers of credit and to use it only when necessary. By following these tips, you can avoid the pitfalls of credit and use it to your advantage.

Insurance

Dave Ramsey, a renowned financial expert, emphasizes the significance of insurance for young individuals as a cornerstone of financial security. His "Baby Steps" plan outlines specific guidelines for incorporating insurance into a comprehensive financial strategy.

- Health Insurance

Health insurance safeguards against unexpected medical expenses that can derail financial stability. Young people often overlook its importance, but Ramsey stresses the need for coverage to protect against unforeseen illnesses or accidents.

- Disability Insurance

Disability insurance provides a safety net in case of an injury or illness that prevents an individual from working. Ramsey recommends young people consider this coverage to ensure income continuity despite unforeseen circumstances.

- Life Insurance

Life insurance offers financial protection for dependents in the event of the policyholder's untimely demise. Ramsey advises young individuals with families to obtain adequate coverage to safeguard their loved ones' financial well-being.

- Property and Liability Insurance

Property and liability insurance protects against financial losses resulting from damage to personal property or legal claims. Ramsey encourages young people to secure coverage for their vehicles, homes, and other valuable assets.

Incorporating these types of insurance into a financial plan provides young individuals with a strong foundation for long-term financial success. By following Ramsey's guidance, they can mitigate risks, protect their assets, and ensure peace of mind for themselves and their families.

Taxes

Taxes play a crucial role in Dave Ramsey's financial plan for young people. Ramsey believes that young people should understand the importance of paying taxes and plan accordingly.

One of the most important things that young people can do is to make sure that they are withholding enough taxes from their paychecks. If they don't withhold enough taxes, they may end up owing money to the government when they file their taxes. This can result in penalties and interest charges.

Another important thing that young people should do is to file their taxes on time. The deadline for filing taxes is April 15th of each year. If you file your taxes late, you may have to pay penalties and interest charges.Paying taxes can be a daunting task, but it's important to remember that taxes are used to fund important government programs and services. By paying your taxes, you are helping to support your community and your country.Here are some tips for young people who are filing their taxes for the first time:

- Gather all of your tax documents, such as your W-2s and 1099s.

- Choose a tax preparation method, such as using a tax software program or hiring a tax preparer.

- File your taxes on time, either by mail or electronically.

Retirement

Retirement planning is a crucial aspect of Dave Ramsey's financial plan for young people. Ramsey believes that young people should start saving for retirement as early as possible, even if it's just a small amount. By starting early, young people can take advantage of the power of compound interest and grow their retirement savings over time.

- Start Early

One of the most important things young people can do for their financial future is to start saving for retirement early. The sooner you start saving, the more time your money has to grow. Even if you can only save a small amount each month, it will add up over time.

- Take Advantage of Compound Interest

Compound interest is the interest that you earn on your interest. Over time, compound interest can help you grow your retirement savings exponentially. For example, if you invest $1,000 at a 10% interest rate, it will grow to $2,593 in 20 years. However, if you wait 10 years to start investing, it will only grow to $1,610.

- Choose the Right Investments

There are many different types of investments available for retirement savings. It's important to choose investments that are right for your risk tolerance and financial goals. If you're not sure what to invest in, you can talk to a financial advisor.

- Make Regular Contributions

One of the best ways to reach your retirement goals is to make regular contributions to your retirement account. This will help you stay on track and reach your goals faster.

Retirement planning may seem daunting, but it's important to start early and take advantage of the power of compound interest. By following these tips, young people can set themselves up for a secure and comfortable retirement.

FAQs

Dave Ramsey's financial advice has helped millions of people achieve financial success. His plan for young people is designed to help them get a head start on saving, investing, and building a strong financial foundation.

Question 1: Is Dave Ramsey's plan too restrictive?

Answer: Dave Ramsey's plan is designed to help people get out of debt and build wealth. It may seem restrictive at first, but it is a proven plan that works. Ramsey's plan is based on the principles of living on a budget, saving money, and investing for the future.

Question 2: Is it possible to follow Dave Ramsey's plan while still enjoying life?

Answer: Yes, it is possible to follow Dave Ramsey's plan and still enjoy life. Ramsey's plan is not about deprivation. It is about making wise financial choices so that you can have more freedom and flexibility in the future.

Question 3: Is Dave Ramsey's plan only for people who are already in debt?

Answer: No, Dave Ramsey's plan is for anyone who wants to improve their financial situation. Whether you are in debt or not, Ramsey's plan can help you get on track to financial success.

Question 4: How long does it take to see results from following Dave Ramsey's plan?

Answer: The amount of time it takes to see results from following Dave Ramsey's plan will vary depending on your individual circumstances. However, most people start to see results within a few months.

Question 5: Is Dave Ramsey's plan worth it?

Answer: Yes, Dave Ramsey's plan is worth it. If you are serious about improving your financial situation, Ramsey's plan can help you get there. Ramsey's plan is based on sound financial principles that have helped millions of people achieve financial success.

Question 6: Where can I learn more about Dave Ramsey's plan?

Answer: You can learn more about Dave Ramsey's plan by visiting his website, reading his books, or listening to his radio show. You can also find Dave Ramsey's plan discussed in many personal finance blogs and articles.

Dave Ramsey's plan for young people is a proven plan that can help you achieve financial success. If you are willing to follow his advice, you can get out of debt, build wealth, and secure your financial future.

Transition to the next article section:

Dave Ramsey's Tips for Young People

Dave Ramsey is a financial expert who has helped millions of people get out of debt and build wealth. He has a special focus on helping young people get a head start on their financial journey.

Here are some of Dave Ramsey's top tips for young people:

Tip 1: Start saving early

The sooner you start saving, the more time your money has to grow. Even if you can only save a small amount each month, it will add up over time.

Tip 2: Avoid debt

Debt can be a major obstacle to financial success. If you can, avoid going into debt. If you do have debt, make a plan to pay it off as quickly as possible.

Tip 3: Invest for the future

Investing is one of the best ways to grow your wealth. Start investing as early as possible, even if it's just a small amount. Over time, your investments will grow and help you reach your financial goals.

Tip 4: Live below your means

One of the best ways to save money is to live below your means. This means spending less than you earn. Create a budget and stick to it. This will help you save money and reach your financial goals faster.

Tip 5: Be disciplined

Financial success requires discipline. You need to be disciplined about saving, investing, and living below your means. If you are not disciplined, it will be difficult to reach your financial goals.

Summary

If you follow these tips, you will be well on your way to financial success. Remember, it takes time and effort to build wealth. But if you are patient and persistent, you will eventually reach your goals.

Conclusion

Dave Ramsey's financial advice has helped millions of people, including young people, achieve financial success. His plan for young people is based on the principles of living on a budget, saving money, and investing for the future. By following his advice, young people can get a head start on their financial journey and set themselves up for a lifetime of financial success.

Key points of Dave Ramsey's plan for young people include:

- Start saving early

- Avoid debt

- Invest for the future

- Live below your means

- Be disciplined

If you are a young person who wants to improve your financial situation, I encourage you to follow Dave Ramsey's plan. It is a proven plan that can help you get out of debt, build wealth, and secure your financial future.

Unveiling Katerina Rawlings' Net Worth: A Journey To Financial Success

Unveiling The Hidden World Of Olivia Rodrigo's Parents: A Journey Of Inspiration And Support

Uncover The Secrets Of Arielle Lorre's Birthday: A Journey Of Discovery

ncG1vNJzZmibkaOxqrjEZ6psZqWoerix0q1ka2aRoq67u82arqxmk6S6cLDAr5xmqpGiwKbFjLKmrqaXY7W1ucs%3D